We have over 14,000 stocks and bonds.

GERMAN BONDS

CHINESE BONDS

MEXICANA BONDS

RUSSIAN BONDS

PLEASE CLICK ON COUNTRY NAME BELOW TO SEE THE BOND INVENTORY

GERMAN BONDS

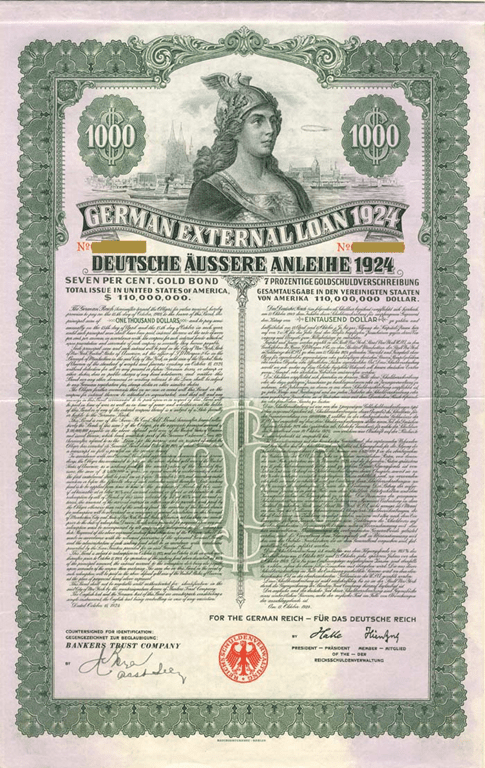

German Dawes External Gold Loan 7% 1924 Bond

Country: Germany

Years: 1924

$1,000, 7%, Gold Dawes Bond.

The Dawes Plan (as proposed by the Dawes Committee, chaired by Charles G. Dawes) was a plan in 1924 that successfully resolved the issue of World War I reparations that Germany had to pay. It ended a crisis in European diplomacy following World War I and the Treaty of Versailles.

The plan provided for an end to the Allied occupation, and a staggered payment plan for Germany’s payment of war reparations. Because the Plan resolved a serious international crisis, Dawes shared the Nobel Peace Prize in 1925 for his work.

It was an interim measure and proved unworkable. The Young Plan was adopted in 1929 to replace it.

At the conclusion of World War I, the Allied and Associate Powers included in the Treaty of Versailles a plan for reparations to be paid by Germany; 20 billion gold marks was to be paid while the final figure was decided. In 1921, the London Schedule of Payments established the German reparation figure at 132 billion gold marks (separated into various classes, of which only 50 billion gold marks was required to be paid). German industrialists in the Ruhr Valley, who had lost factories in Lorraine which went back to France after the war, demanded hundreds of millions of marks compensation from the German government.

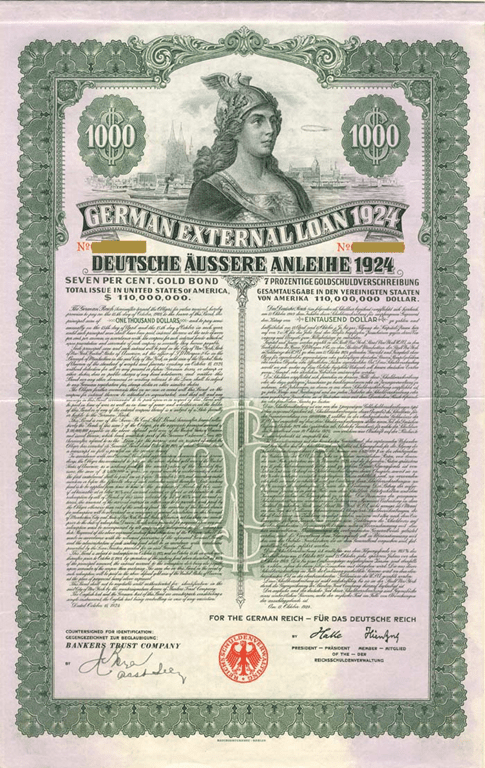

German Dawes External Gold Loan 7% 1924 Bond

Country: Germany

Years: 1924

$1,000, 7%, Gold Dawes Bond.

The Dawes Plan (as proposed by the Dawes Committee, chaired by Charles G. Dawes) was a plan in 1924 that successfully resolved the issue of World War I reparations that Germany had to pay. It ended a crisis in European diplomacy following World War I and the Treaty of Versailles.

The plan provided for an end to the Allied occupation, and a staggered payment plan for Germany’s payment of war reparations. Because the Plan resolved a serious international crisis, Dawes shared the Nobel Peace Prize in 1925 for his work.

It was an interim measure and proved unworkable. The Young Plan was adopted in 1929 to replace it.

At the conclusion of World War I, the Allied and Associate Powers included in the Treaty of Versailles a plan for reparations to be paid by Germany; 20 billion gold marks was to be paid while the final figure was decided. In 1921, the London Schedule of Payments established the German reparation figure at 132 billion gold marks (separated into various classes, of which only 50 billion gold marks was required to be paid). German industrialists in the Ruhr Valley, who had lost factories in Lorraine which went back to France after the war, demanded hundreds of millions of marks compensation from the German government.

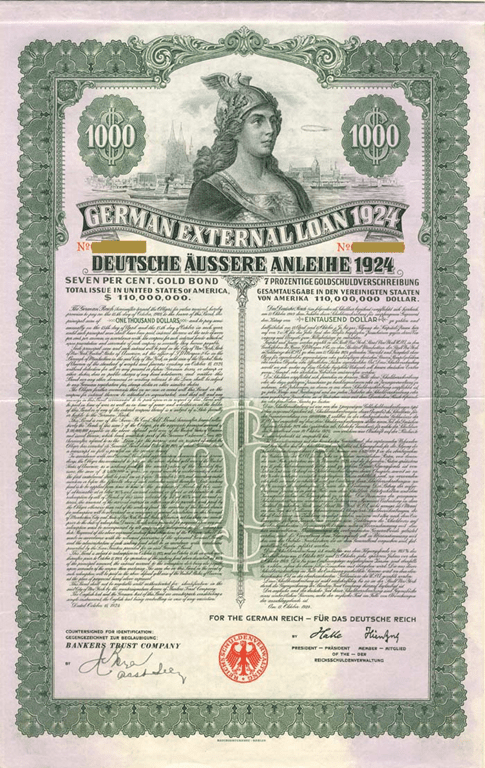

German Dawes External Gold Loan 7% 1924 Bond

Country: Germany

Years: 1924

$1,000, 7%, Gold Dawes Bond.

The Dawes Plan (as proposed by the Dawes Committee, chaired by Charles G. Dawes) was a plan in 1924 that successfully resolved the issue of World War I reparations that Germany had to pay. It ended a crisis in European diplomacy following World War I and the Treaty of Versailles.

The plan provided for an end to the Allied occupation, and a staggered payment plan for Germany’s payment of war reparations. Because the Plan resolved a serious international crisis, Dawes shared the Nobel Peace Prize in 1925 for his work.

It was an interim measure and proved unworkable. The Young Plan was adopted in 1929 to replace it.

At the conclusion of World War I, the Allied and Associate Powers included in the Treaty of Versailles a plan for reparations to be paid by Germany; 20 billion gold marks was to be paid while the final figure was decided. In 1921, the London Schedule of Payments established the German reparation figure at 132 billion gold marks (separated into various classes, of which only 50 billion gold marks was required to be paid). German industrialists in the Ruhr Valley, who had lost factories in Lorraine which went back to France after the war, demanded hundreds of millions of marks compensation from the German government.

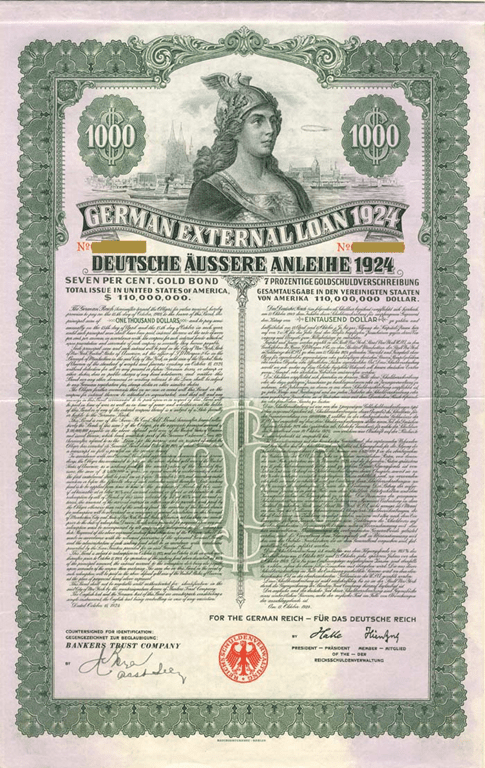

German Dawes External Gold Loan 7% 1924 Bond

Country: Germany

Years: 1924

$1,000, 7%, Gold Dawes Bond.

The Dawes Plan (as proposed by the Dawes Committee, chaired by Charles G. Dawes) was a plan in 1924 that successfully resolved the issue of World War I reparations that Germany had to pay. It ended a crisis in European diplomacy following World War I and the Treaty of Versailles.

The plan provided for an end to the Allied occupation, and a staggered payment plan for Germany’s payment of war reparations. Because the Plan resolved a serious international crisis, Dawes shared the Nobel Peace Prize in 1925 for his work.

It was an interim measure and proved unworkable. The Young Plan was adopted in 1929 to replace it.

At the conclusion of World War I, the Allied and Associate Powers included in the Treaty of Versailles a plan for reparations to be paid by Germany; 20 billion gold marks was to be paid while the final figure was decided. In 1921, the London Schedule of Payments established the German reparation figure at 132 billion gold marks (separated into various classes, of which only 50 billion gold marks was required to be paid). German industrialists in the Ruhr Valley, who had lost factories in Lorraine which went back to France after the war, demanded hundreds of millions of marks compensation from the German government.

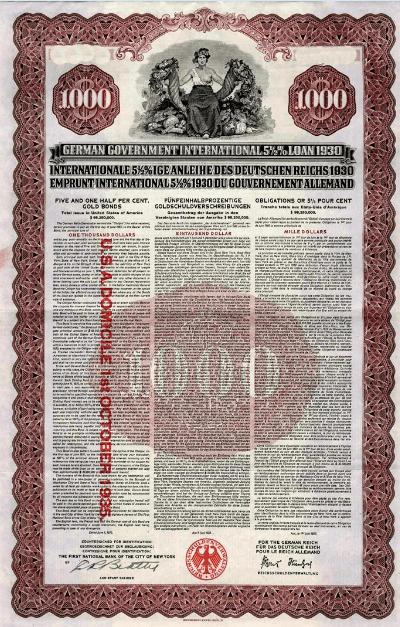

Country: Germany

Years: June 1, 1930

German Government International 5 1/2% Loan 1930 Uncancelled Bond. Full page of coupons attached. Text in English, German, and French.

Condition: Excellent

CHINESE BONDS

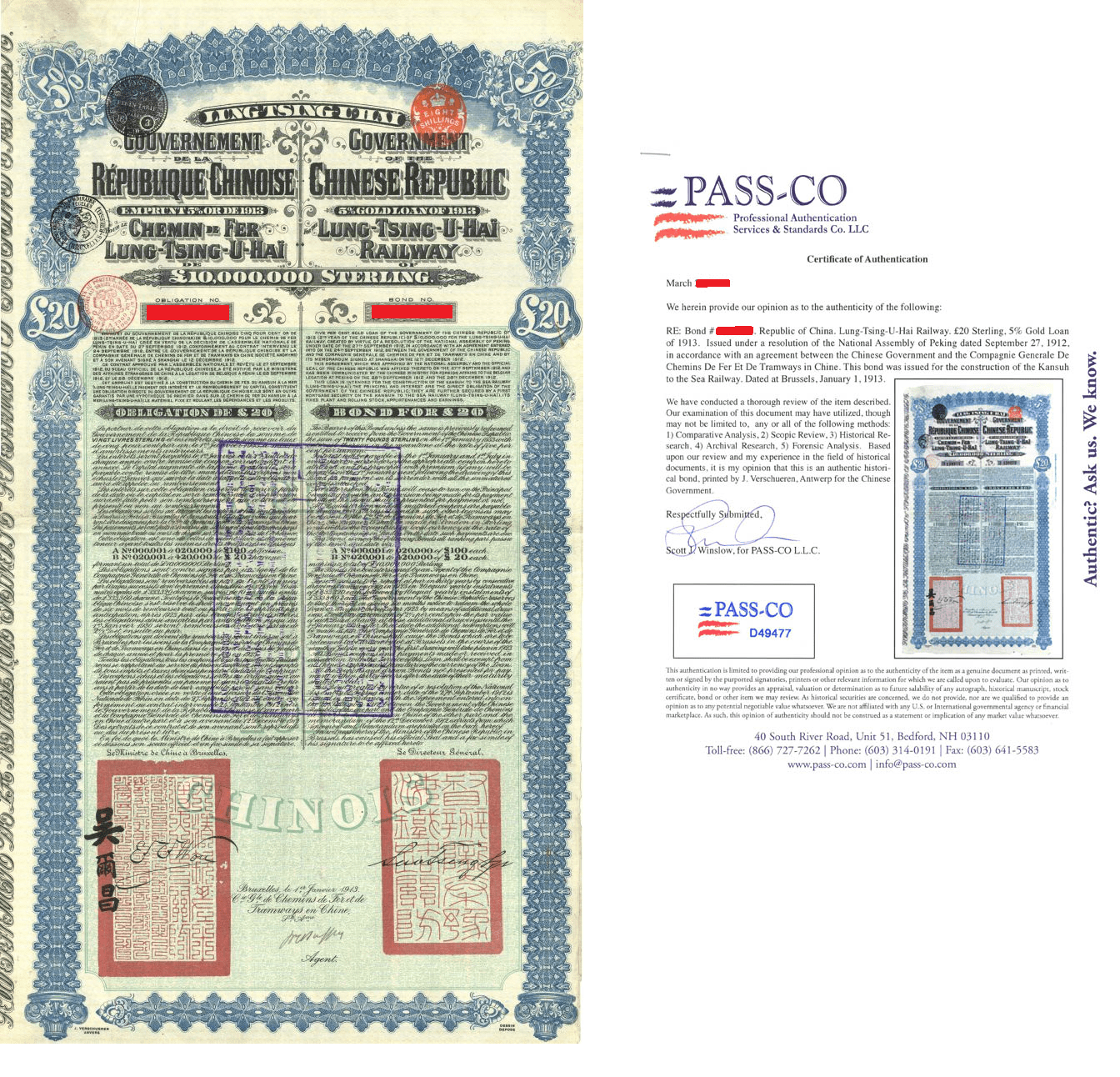

Super Petchili Bond with Pass-Co Authentication – Chinese Republic 20 Pound Lung-Tsing-U-Hai Railway

Color: Blue

Government of the Chinese Republic, 5% GOLD LOAN OF 1913 LUNG-TSING-U-HAI RAILWAY of £10,000,000 Sterling BOND FOR £20 denomination with Pass-Co Authentication.

New article relating to this Chinese item: https://www.bloomberg.com/news/articles/2019-08-29/trump-s-new-trade-war-weapon-might-just-be-antique-china-debt

LUNG TSING U HAI RAILWAY BOND. Titles and Text: Repeated in French and English. Printer: J. Verschueren, Anvers, Belgium. Size: Large Format, 11×20″ plus 10×20″ Coupon at right. Also called the Belgian Lanshow Railway Loan. Authorized £10,000,000. But only £4,000,000 were issued in 1913 and offered by the Banque Belge at Fr 461.40 for each Fr 500 or £20 Bond in Brussels and Paris on behalf of the Co. Gen. Chemins de Fer et de Tramways en Chine. For the construction and equipment of a main line (1125 miles) between Lanchow (on the West) and Haichow on the sea (north of the Yantze), utilizing the Pienlo Railway. Number of coupons will vary from 42 or so. Known as the “Super Petchili”.

Condition: Extremely Fine

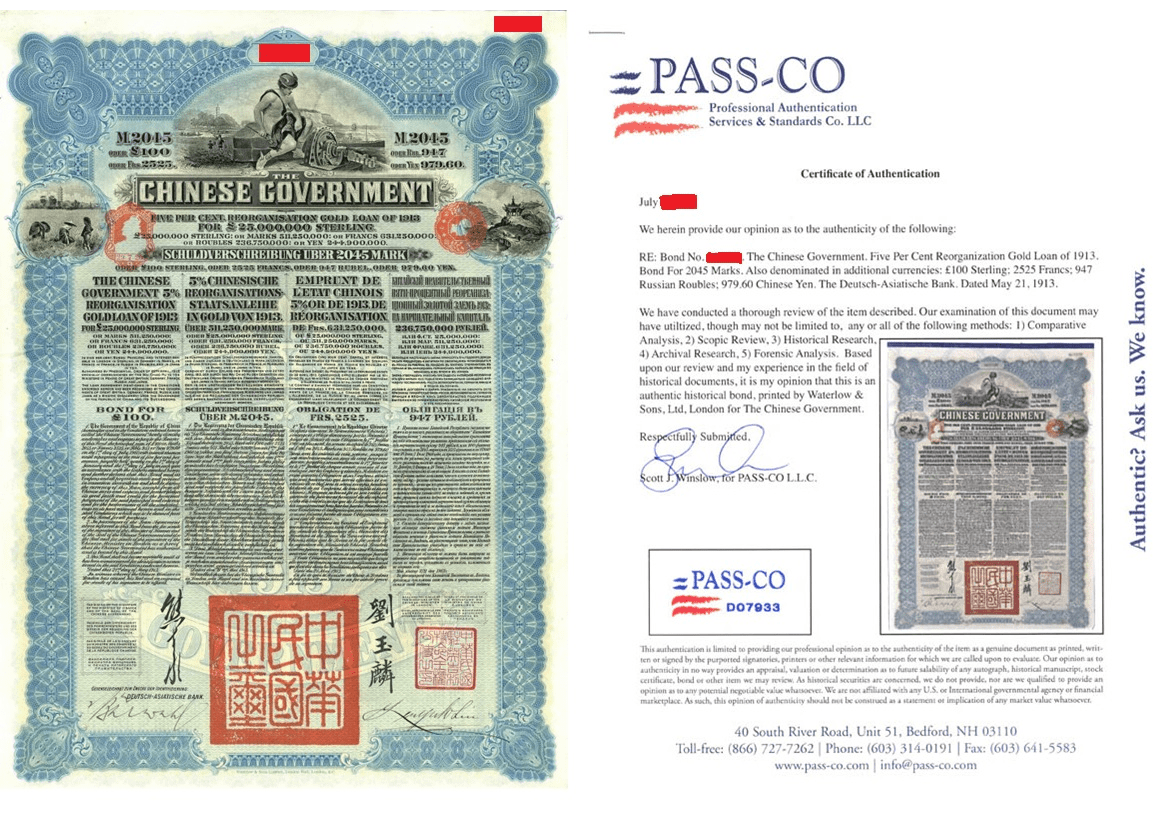

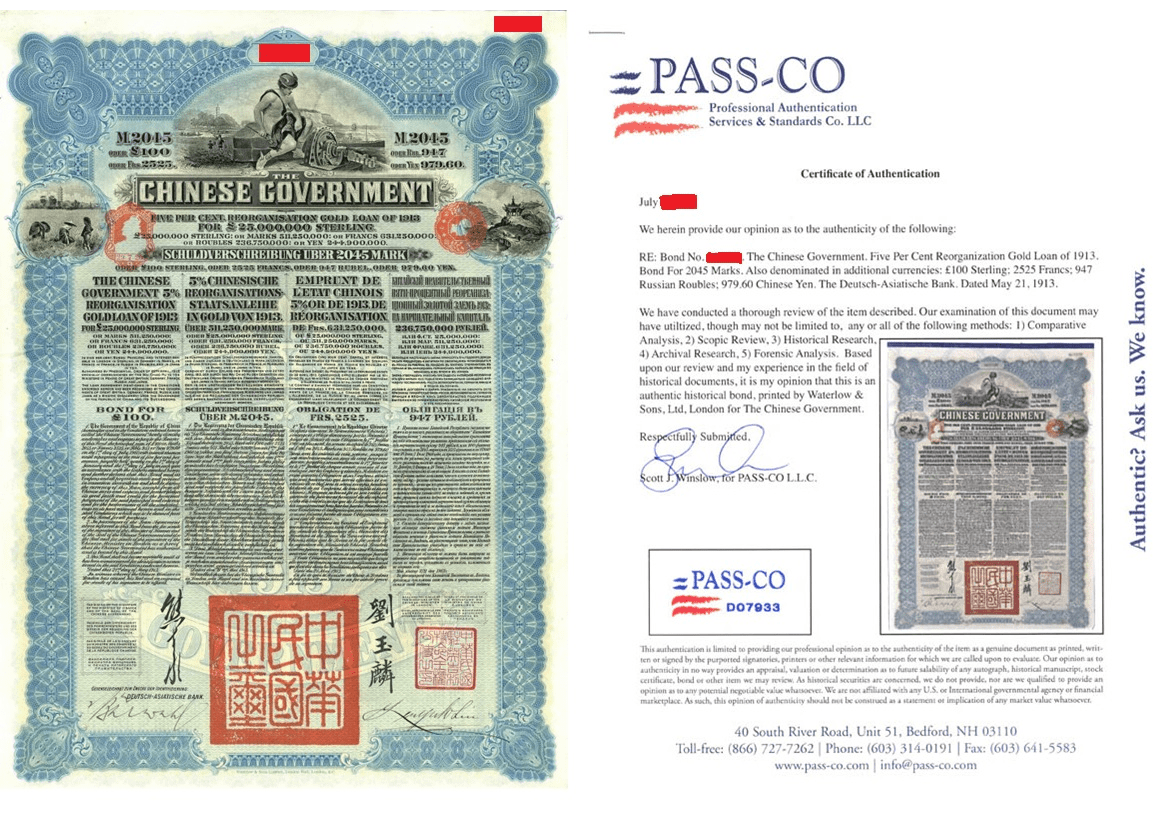

Chinese £100 Reorganization Gold Loan Blue Bond of 1913 with PASS-CO authentication

China, 1913, Blue-Red. £100 5% Reorganization Gold Loan Bond, German Bank Issued. Uncancelled. 42-43 Coupons. Many coupons.

New article relating to this Chinese item: https://www.bloomberg.com/news/articles/2019-08-29/trump-s-new-trade-war-weapon-might-just-be-antique-china-debt

1913 – 5% Reorganisation Gold Loan The Reorganisation Gold Loan of 1913 was for the capital sum of £25,000,000. The Loan was, “…authorized by Presidential Order of 22nd April 1913 officially communicated by the Wai Chiao Pu to the Ministers in Peking of Great Britain, Germany, France, Russia and Japan.” The newly appointed President of the Republic of China, Yuan Shih Kai, initially approached Britain, France, Germany and United States of America seeking a substantial loan to assist the fledgling government of the Republic of China. Later this group was expanded to include Japan and Russia, but eventually the United States of America withdrew from participation, leaving five countries which agreed to assist the Chinese Government with financial aid. The principal financial institutions which participated in the loan arrangements were the Hongkong & Shanghai Banking Corporation, Deutsch-Asiatiche Bank, Banque de I’Indo-Chine and Russian Asiatic Bank. The Yokohama Specie Bank participated on behalf of Japan, but did not issue separate bonds, countersigned by the bank.

Arrangements were made as to convertibility into Japanese Yen of the bearer bonds issued by the other four issuing banks. The banks all received 6% commission allocated to each bank together with bonds issued are detailed in the data tables below: Hongkong & Shanghai Banking Corporation £7,416,680 Deutsch-Asiatiche Bank £6,000,000 Banque de I’Indo-Chine £7,416,660 Russian Asiatic Bank £2,777,780 Russian Asiatic Bank (Belgium) £1,388,880 It should be noted that the original Russian issue bonds which were brown coloured, were subsequently withdrawn and exchanged for a series of green coloured bonds. The original brown coloured bonds, sometimes referred to as “Yellow Bonds” were annulled. In consequence there may still be bonds in existence of two different colours from the Russian issue carrying identical serial numbers. The purpose of the loan was to enable the new government of the Republic of China to meet financial liabilities inherited from the previous organization of government institutions and to meet the administrative costs. The loan was secured upon the entire revenues of the Salt Administration of China. In some ways this was a rather dubious security for such a large-scale loan as the entire Salt Gabelle (Salt Tax) had already been committed for other purposes with any surplus being pledged as a security against the Crisp Loan of 1912.

However there was a further provision that foreigners would assist in the reorganisation of the collection of Salt Tax revenues and if the loan was at any time in default, the Salt Tax revenues were to be administered by the Maritime Customs Administration which was primarily under the control of foreigners. Coupons were payable on 1st January and 1st July each year. The loan has been in default since 1939. As an interesting footnote to this loan, Mr. M.E. Weatherall, who was a senior official of the Chinese Maritime customs Service in 1921 was quoted in the publication “Wayfoong” as making the following observation; “I believe that I am correct in saying that the greater part, if not all, of the reorganisation loan of 1913 was accounted for by statements and vouchers, but that in actual fact very little of it was ever applied to the purposes for which it was lent. It disappeared mysteriously and nobody knows where it has gone.”

Condition: Extremely Fine

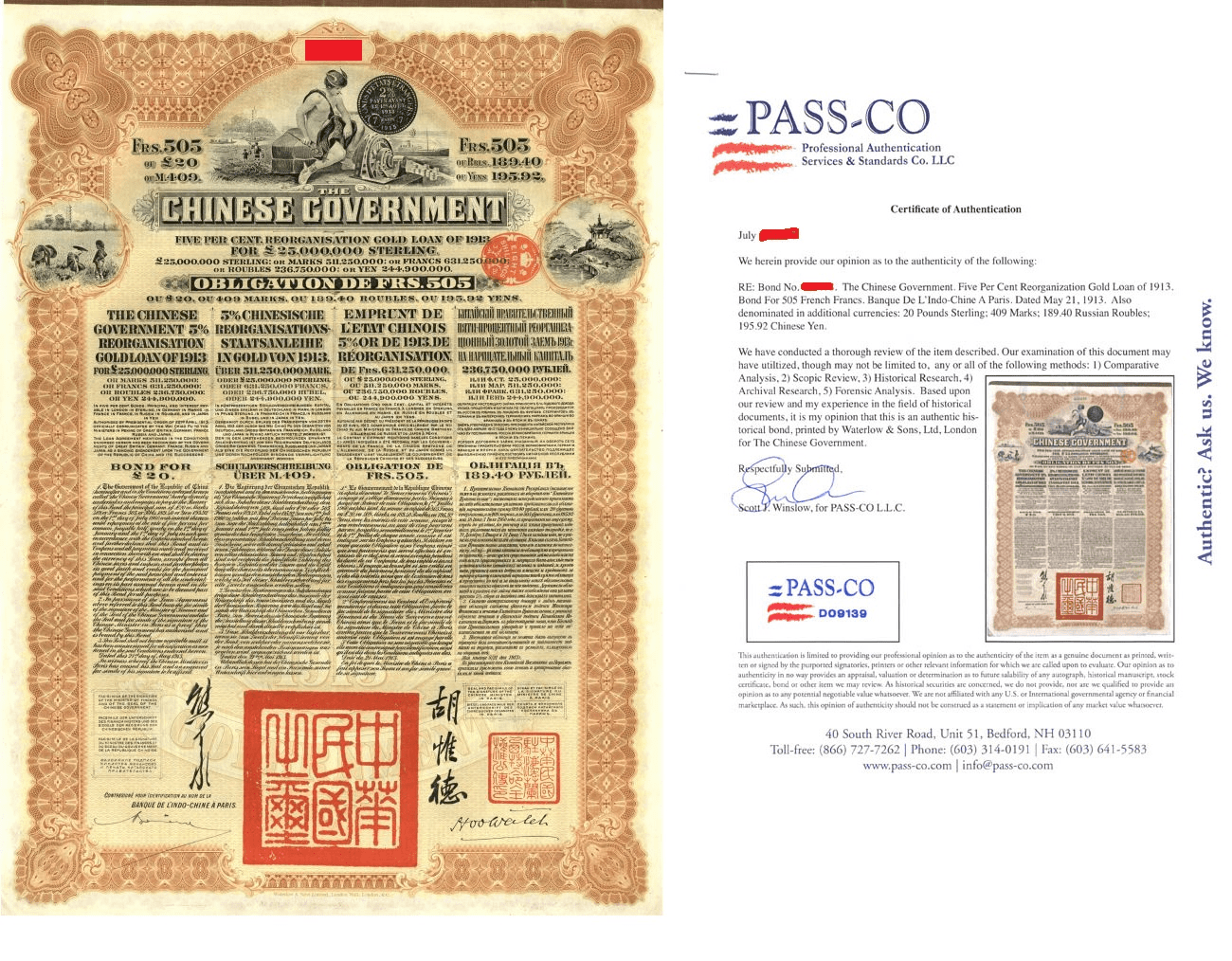

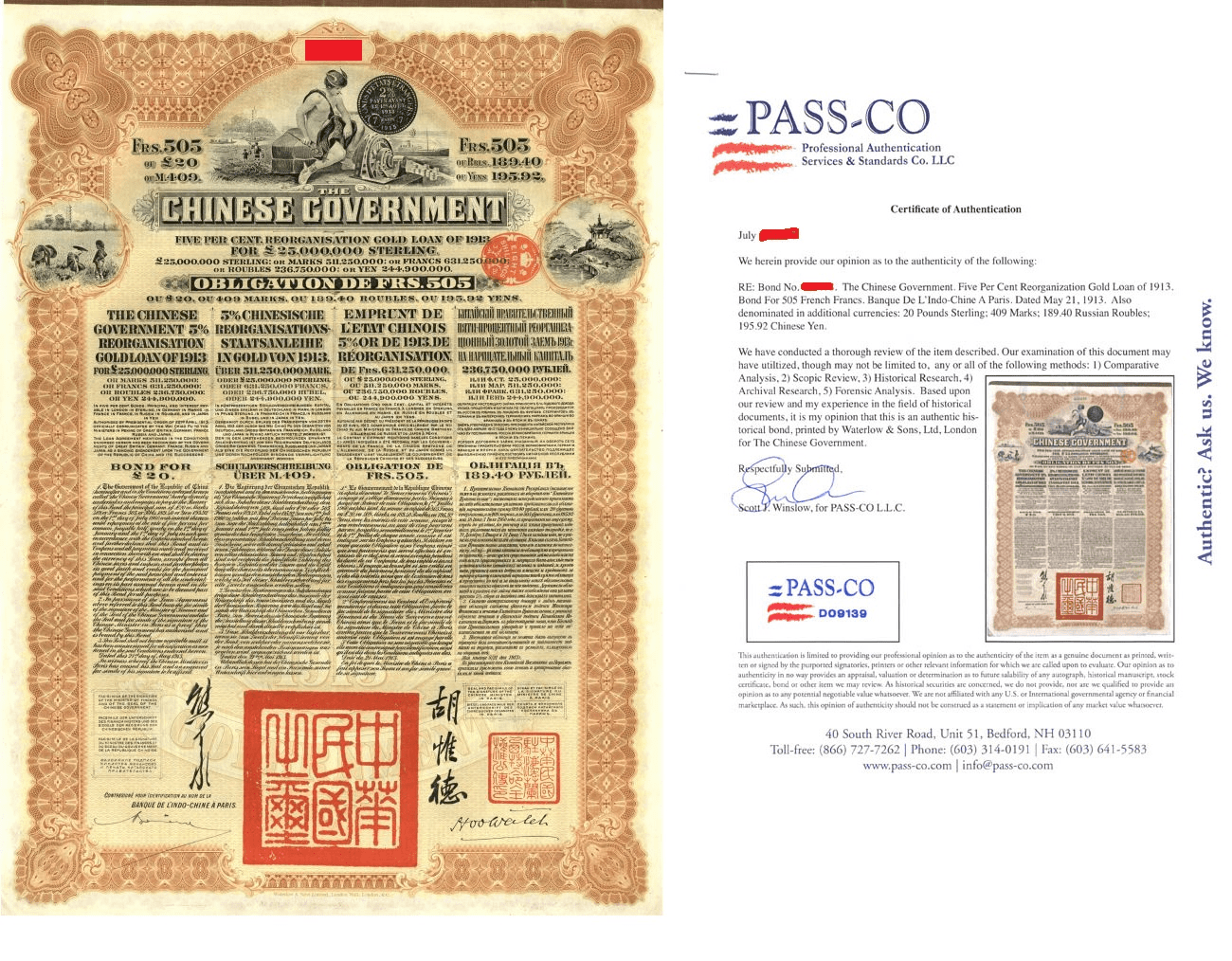

Chinese £20 Reorganization Gold Loan Brown Bond of 1913 with PASS-CO authentication

Country: China

Years: 1913

Color: Brown

New article relating to this Chinese item: https://www.bloomberg.com/news/articles/2019-08-29/trump-s-new-trade-war-weapon-might-just-be-antique-china-debt

1913 – 5% Reorganisation Gold Loan The Reorganisation Gold Loan of 1913 was for the capital sum of £25,000,000. The Loan was, “…authorized by Presidential Order of 22nd April 1913 officially communicated by the Wai Chiao Pu to the Ministers in Peking of Great Britain, Germany, France, Russia and Japan.” The newly appointed President of the Republic of China, Yuan Shih Kai, initially approached Britain, France, Germany and United States of America seeking a substantial loan to assist the fledgling government of the Republic of China. Later this group was expanded to include Japan and Russia, but eventually the United States of America withdrew from participation, leaving five countries which agreed to assist the Chinese Government with financial aid. The principal financial institutions which participated in the loan arrangements were the Hongkong & Shanghai Banking Corporation, Deutsch-Asiatiche Bank, Banque de I’Indo-Chine and Russian Asiatic Bank. The Yokohama Specie Bank participated on behalf of Japan, but did not issue separate bonds, countersigned by the bank. Arrangements were made as to convertibility into Japanese Yen of the bearer bonds issued by the other four issuing banks. The banks all received 6% commission allocated to each bank together with bonds issued are detailed in the data tables below: Hongkong & Shanghai Banking Corporation £7,416,680 Deutsch-Asiatiche Bank £6,000,000 Banque de I’Indo-Chine £7,416,660 Russian Asiatic Bank £2,777,780 Russian Asiatic Bank (Belgium) £1,388,880 It should be noted that the original Russian issue bonds which were brown coloured, were subsequently withdrawn and exchanged for a series of green coloured bonds. The original brown coloured bonds, sometimes referred to as “Yellow Bonds” were annulled. In consequence there may still be bonds in existence of two different colours from the Russian issue carrying identical serial numbers. The purpose of the loan was to enable the new government of the Republic of China to meet financial liabilities inherited from the previous organization of government institutions and to meet the administrative costs. The loan was secured upon the entire revenues of the Salt Administration of China. In some ways this was a rather dubious security for such a large-scale loan as the entire Salt Gabelle (Salt Tax) had already been committed for other purposes with any surplus being pledged as a security against the Crisp Loan of 1912. However there was a further provision that foreigners would assist in the reorganisation of the collection of Salt Tax revenues and if the loan was at any time in default, the Salt Tax revenues were to be administered by the Maritime Customs Administration which was primarily under the control of foreigners. Coupons were payable on 1st January and 1st July each year. The loan has been in default since 1939. As an interesting footnote to this loan, Mr. M.E. Weatherall, who was a senior official of the Chinese Maritime customs Service in 1921 was quoted in the publication “Wayfoong” as making the following observation; “I believe that I am correct in saying that the greater part, if not all, of the reorganisation loan of 1913 was accounted for by statements and vouchers, but that in actual fact very little of it was ever applied to the purposes for which it was lent. It disappeared mysteriously and nobody knows where it has gone.”

Condition: Extremely Fine

Chinese £100 Reorganization Gold Loan Blue Bond of 1913 with PASS-CO authentication

China, 1913, Blue-Red. £100 5% Reorganization Gold Loan Bond, German Bank Issued. Uncancelled. 42-43 Coupons. Many coupons.

New article relating to this Chinese item: https://www.bloomberg.com/news/articles/2019-08-29/trump-s-new-trade-war-weapon-might-just-be-antique-china-debt

1913 – 5% Reorganisation Gold Loan The Reorganisation Gold Loan of 1913 was for the capital sum of £25,000,000. The Loan was, “…authorized by Presidential Order of 22nd April 1913 officially communicated by the Wai Chiao Pu to the Ministers in Peking of Great Britain, Germany, France, Russia and Japan.” The newly appointed President of the Republic of China, Yuan Shih Kai, initially approached Britain, France, Germany and United States of America seeking a substantial loan to assist the fledgling government of the Republic of China. Later this group was expanded to include Japan and Russia, but eventually the United States of America withdrew from participation, leaving five countries which agreed to assist the Chinese Government with financial aid. The principal financial institutions which participated in the loan arrangements were the Hongkong & Shanghai Banking Corporation, Deutsch-Asiatiche Bank, Banque de I’Indo-Chine and Russian Asiatic Bank. The Yokohama Specie Bank participated on behalf of Japan, but did not issue separate bonds, countersigned by the bank.

Arrangements were made as to convertibility into Japanese Yen of the bearer bonds issued by the other four issuing banks. The banks all received 6% commission allocated to each bank together with bonds issued are detailed in the data tables below: Hongkong & Shanghai Banking Corporation £7,416,680 Deutsch-Asiatiche Bank £6,000,000 Banque de I’Indo-Chine £7,416,660 Russian Asiatic Bank £2,777,780 Russian Asiatic Bank (Belgium) £1,388,880 It should be noted that the original Russian issue bonds which were brown coloured, were subsequently withdrawn and exchanged for a series of green coloured bonds. The original brown coloured bonds, sometimes referred to as “Yellow Bonds” were annulled. In consequence there may still be bonds in existence of two different colours from the Russian issue carrying identical serial numbers. The purpose of the loan was to enable the new government of the Republic of China to meet financial liabilities inherited from the previous organization of government institutions and to meet the administrative costs. The loan was secured upon the entire revenues of the Salt Administration of China. In some ways this was a rather dubious security for such a large-scale loan as the entire Salt Gabelle (Salt Tax) had already been committed for other purposes with any surplus being pledged as a security against the Crisp Loan of 1912.

However there was a further provision that foreigners would assist in the reorganisation of the collection of Salt Tax revenues and if the loan was at any time in default, the Salt Tax revenues were to be administered by the Maritime Customs Administration which was primarily under the control of foreigners. Coupons were payable on 1st January and 1st July each year. The loan has been in default since 1939. As an interesting footnote to this loan, Mr. M.E. Weatherall, who was a senior official of the Chinese Maritime customs Service in 1921 was quoted in the publication “Wayfoong” as making the following observation; “I believe that I am correct in saying that the greater part, if not all, of the reorganisation loan of 1913 was accounted for by statements and vouchers, but that in actual fact very little of it was ever applied to the purposes for which it was lent. It disappeared mysteriously and nobody knows where it has gone.”

Condition: Extremely Fine

Chinese £20 Reorganization Gold Loan Brown Bond of 1913 with PASS-CO authentication

Country: China

Years: 1913

Color: Brown

New article relating to this Chinese item: https://www.bloomberg.com/news/articles/2019-08-29/trump-s-new-trade-war-weapon-might-just-be-antique-china-debt

1913 – 5% Reorganisation Gold Loan The Reorganisation Gold Loan of 1913 was for the capital sum of £25,000,000. The Loan was, “…authorized by Presidential Order of 22nd April 1913 officially communicated by the Wai Chiao Pu to the Ministers in Peking of Great Britain, Germany, France, Russia and Japan.” The newly appointed President of the Republic of China, Yuan Shih Kai, initially approached Britain, France, Germany and United States of America seeking a substantial loan to assist the fledgling government of the Republic of China. Later this group was expanded to include Japan and Russia, but eventually the United States of America withdrew from participation, leaving five countries which agreed to assist the Chinese Government with financial aid. The principal financial institutions which participated in the loan arrangements were the Hongkong & Shanghai Banking Corporation, Deutsch-Asiatiche Bank, Banque de I’Indo-Chine and Russian Asiatic Bank. The Yokohama Specie Bank participated on behalf of Japan, but did not issue separate bonds, countersigned by the bank. Arrangements were made as to convertibility into Japanese Yen of the bearer bonds issued by the other four issuing banks. The banks all received 6% commission allocated to each bank together with bonds issued are detailed in the data tables below: Hongkong & Shanghai Banking Corporation £7,416,680 Deutsch-Asiatiche Bank £6,000,000 Banque de I’Indo-Chine £7,416,660 Russian Asiatic Bank £2,777,780 Russian Asiatic Bank (Belgium) £1,388,880 It should be noted that the original Russian issue bonds which were brown coloured, were subsequently withdrawn and exchanged for a series of green coloured bonds. The original brown coloured bonds, sometimes referred to as “Yellow Bonds” were annulled. In consequence there may still be bonds in existence of two different colours from the Russian issue carrying identical serial numbers. The purpose of the loan was to enable the new government of the Republic of China to meet financial liabilities inherited from the previous organization of government institutions and to meet the administrative costs. The loan was secured upon the entire revenues of the Salt Administration of China. In some ways this was a rather dubious security for such a large-scale loan as the entire Salt Gabelle (Salt Tax) had already been committed for other purposes with any surplus being pledged as a security against the Crisp Loan of 1912. However there was a further provision that foreigners would assist in the reorganisation of the collection of Salt Tax revenues and if the loan was at any time in default, the Salt Tax revenues were to be administered by the Maritime Customs Administration which was primarily under the control of foreigners. Coupons were payable on 1st January and 1st July each year. The loan has been in default since 1939. As an interesting footnote to this loan, Mr. M.E. Weatherall, who was a senior official of the Chinese Maritime customs Service in 1921 was quoted in the publication “Wayfoong” as making the following observation; “I believe that I am correct in saying that the greater part, if not all, of the reorganisation loan of 1913 was accounted for by statements and vouchers, but that in actual fact very little of it was ever applied to the purposes for which it was lent. It disappeared mysteriously and nobody knows where it has gone.”

Condition: Extremely Fine

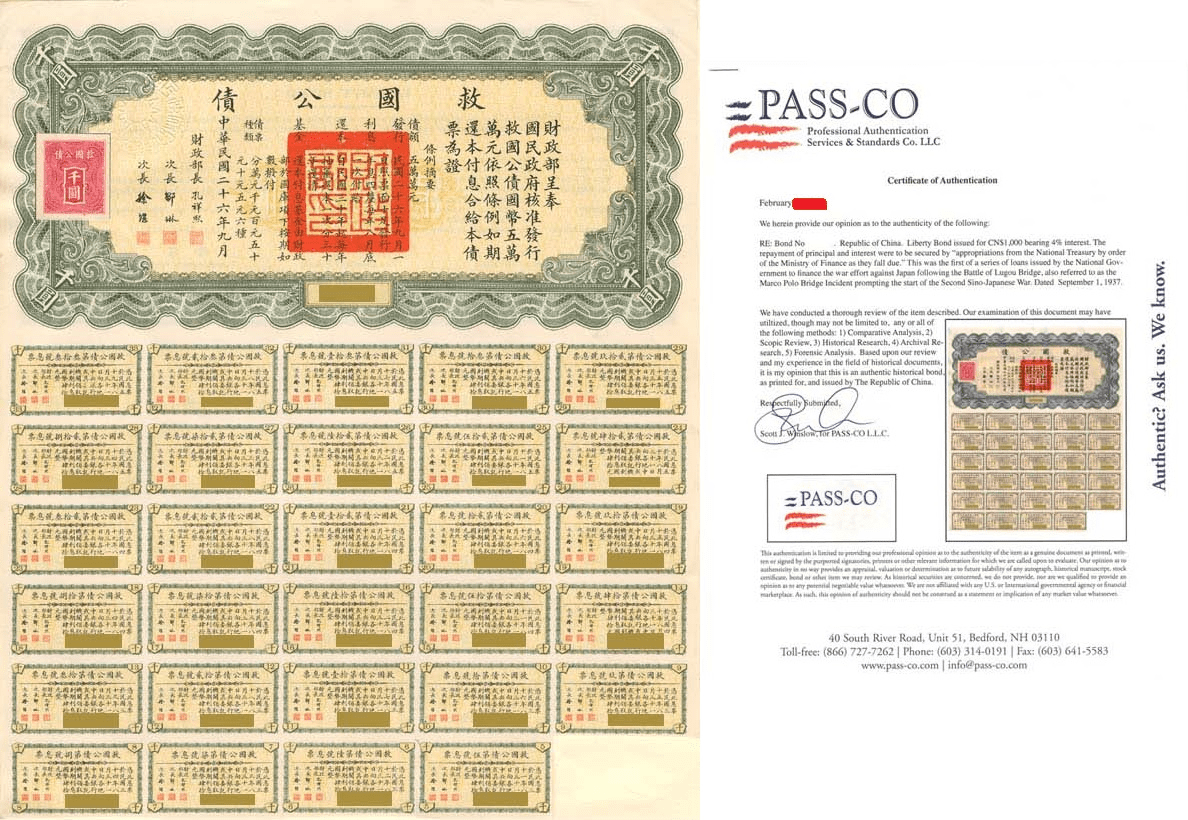

$1,000 Republic of China Liberty Bond

Condition: Excellent

A bond is a document of title for a loan. Bonds are issued, not only by businesses, but also by national, state or city governments, or other public bodies, or sometimes by individuals. Bonds are a loan to the company or other body. They are normally repayable within a stated period of time. Bonds earn interest at a fixed rate, which must usually be paid by the undertaking regardless of its financial results. A bond holder is a creditor of the undertaking.

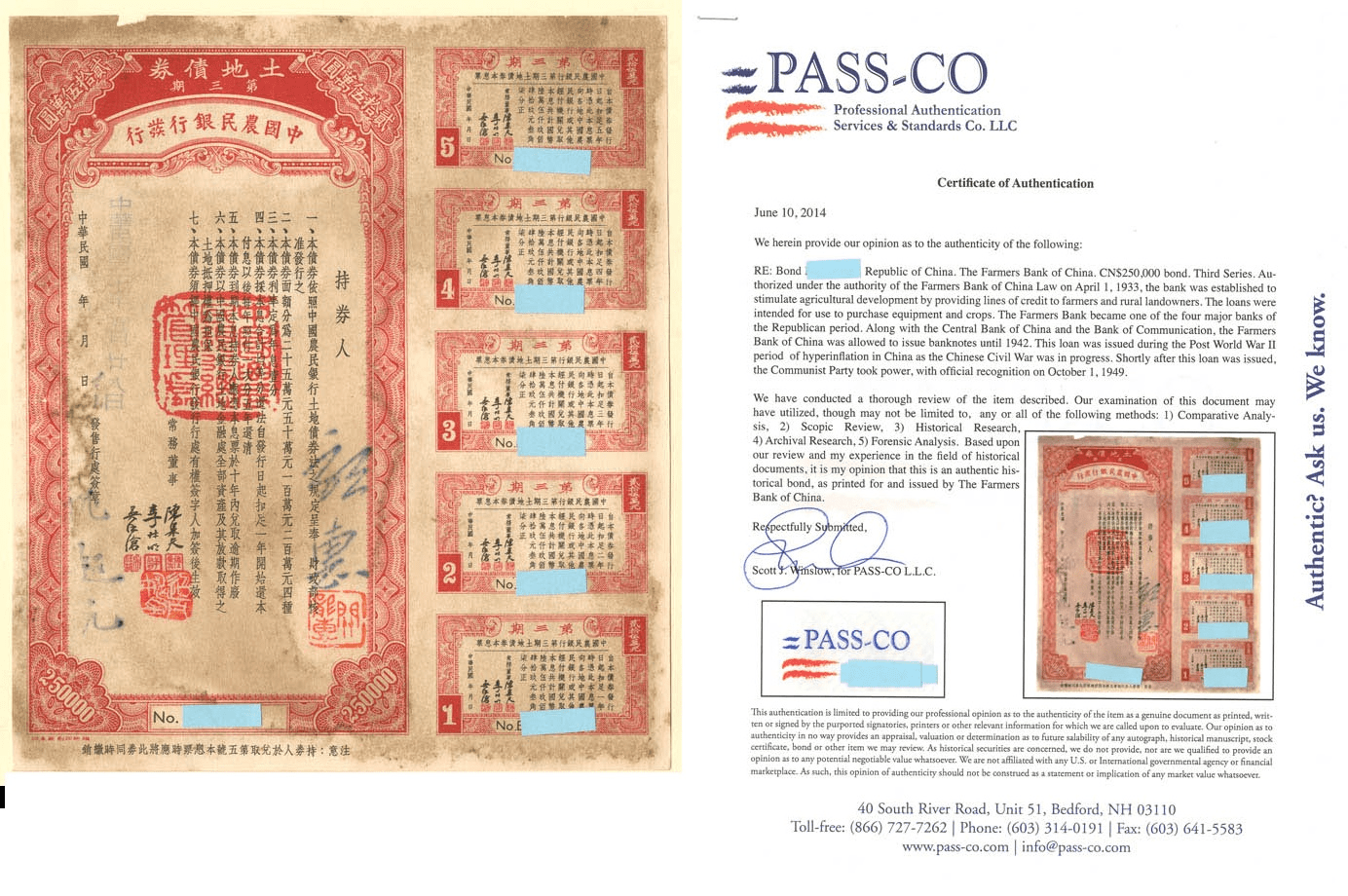

$250,000 Farmers Bank of China Bond

Country: China

Years: 1933

Color: Red

$250,000 Republic of China Bond. The Farmers Bank of China. PASSCO authenticated. New article relating to this Chinese item: https://www.bloomberg.com/news/articles/2019-08-29/trump-s-new-trade-war-weapon-might-just-be-antique-china-debt

Condition: V.F.

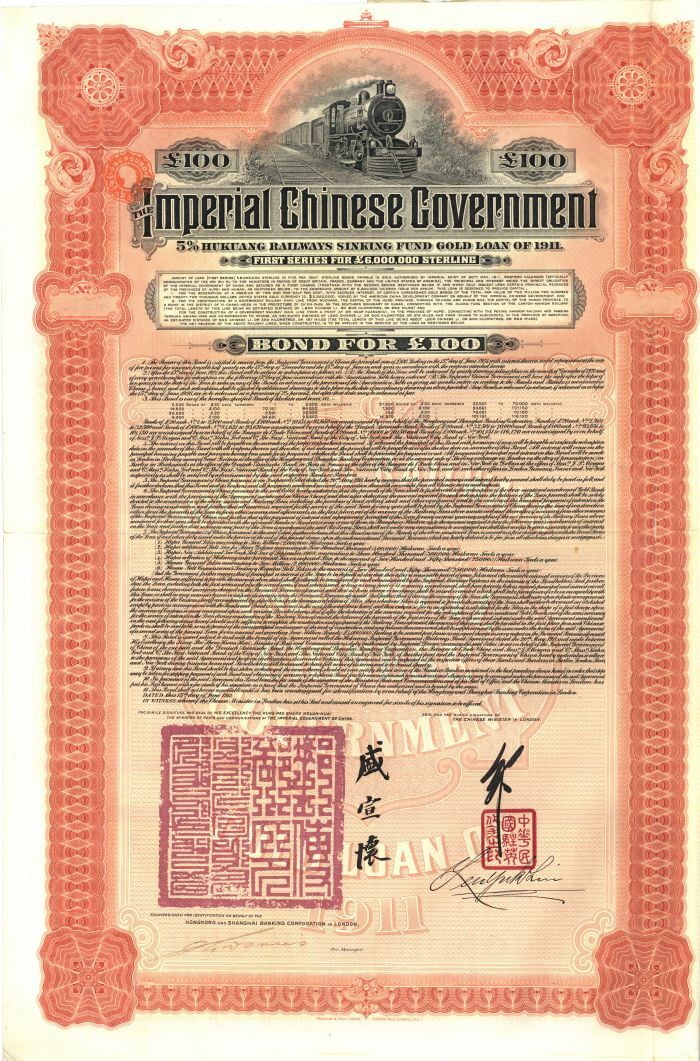

£100 Imperial Chinese Government 1911 Hukuang Railway Gold Bond

Country: China

Years: 1911

£100 5% Hukuang Railways Sinking Fund Gold Loan of 1911 Bond. Uncancelled. Several coupons. It is important to stress that these bonds have been bought in recent years and pretty much taken off the collector market. As a result prices have risen rather dramatically. Several more rows of coupons not shown.

New article relating to this Chinese item:

https://www.bloomberg.com/news/articles/2019-08-29/trump-s-new-trade-war-weapon-might-just-be-antique-china-debt

Condition: Excellent

MEXICANA BONDS

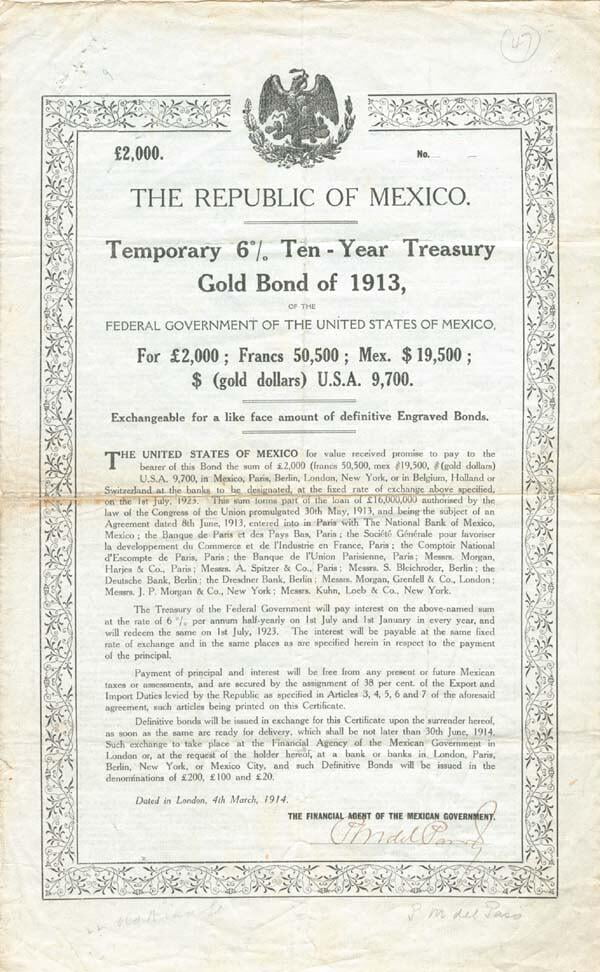

“White Dove” Republic of Mexico – £2,000

Country: Mexico

Years: 1913

£2,000 6% Gold Bond. Nickname: “White Dove”

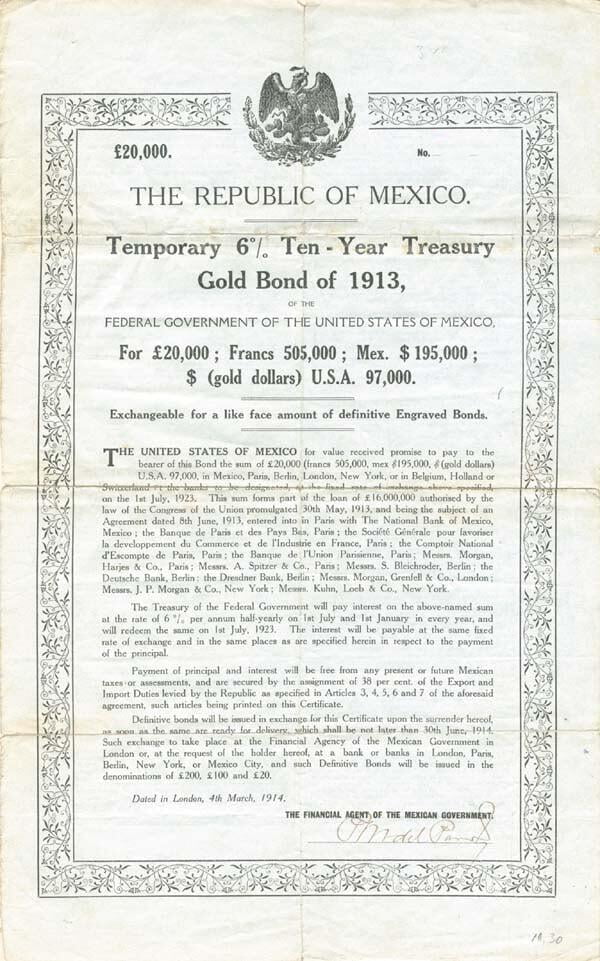

Double White Dove – Republic of Mexico – £20,000 – Bond

Country: Mexico

Years: 1913

£20,000 Temporary 6% Gold Bond. Nickname: “Double White Dove”

Condition: Excellent

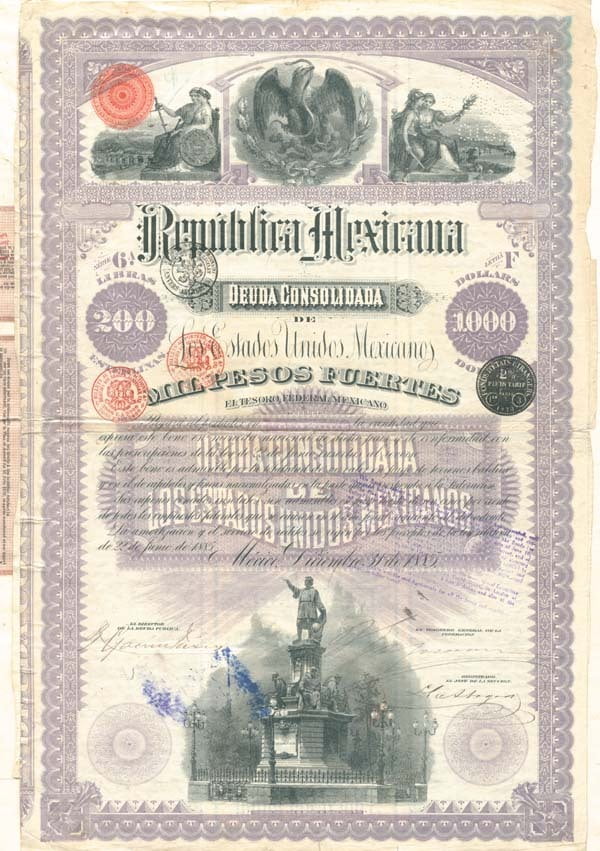

“Christopher Columbus” 1885 – Republica Mexicana

Country: Mexico

Years: 1885

$1,000 Series 6A Bond. Nickname: “Christopher Columbus”

Condition: Excellent

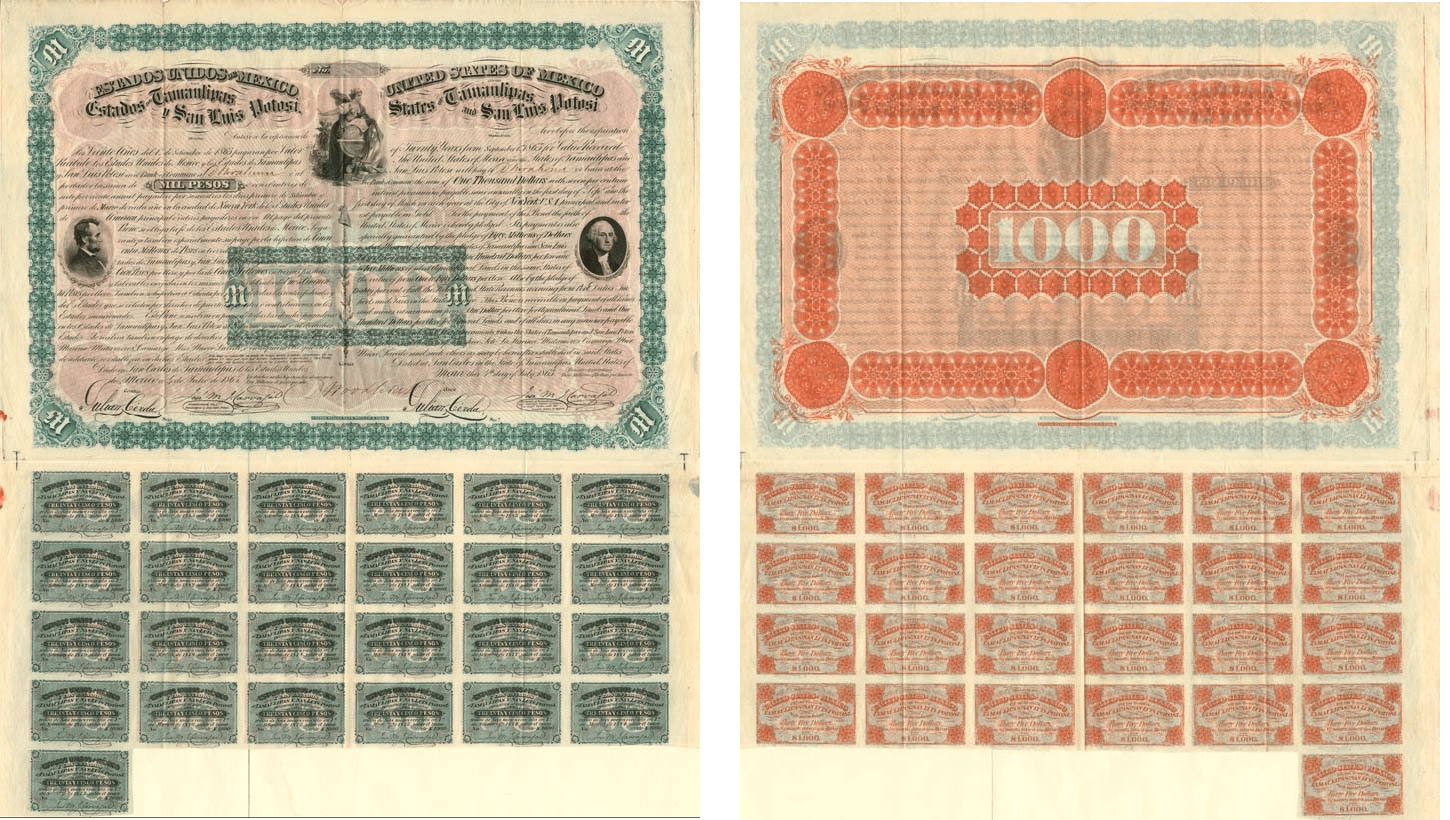

Two Presidents Bond – Tamaulipas and San Luis Potosi

Country: Mexico

Years: 1865

$1,000 or Mil Peos Bond printed by United States Bank Note Co. N. York. Known as “2 Presidents”. Vignettes of Washington and Lincoln! Text in Spanish and English. Rare! Please click on “view larger image” to see back of bond. All have 25 Coupons.

Condition: Excellenta

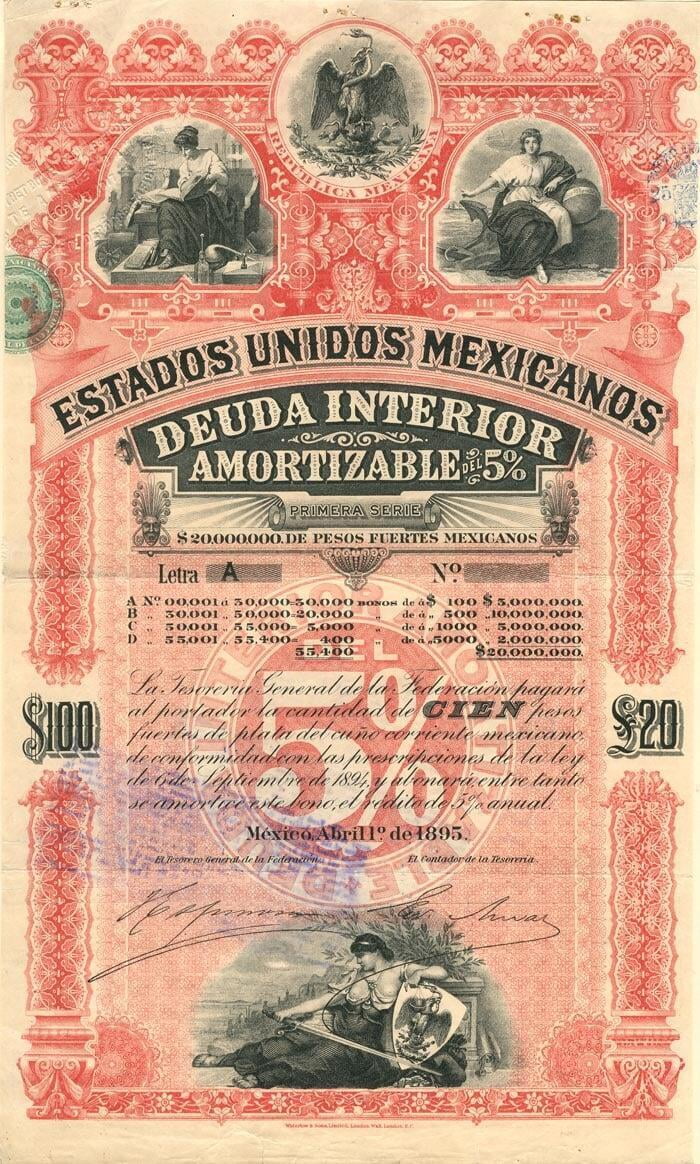

“Pink Lady or Red Diamond” Estados Unidos Mexicanos £20/100 Pesos Bond

Country: Mexico

Years: 1895, 1896, 1898

20 Pound, 100 Pesos, 5%, Series A Bond. Various Letras. Nicknames: “Pink Lady or Red Diamond”. Includes PASS-CO authentication. Available in dates 1895, 1896 or 1898. Please specify date.

Condition: Excellent

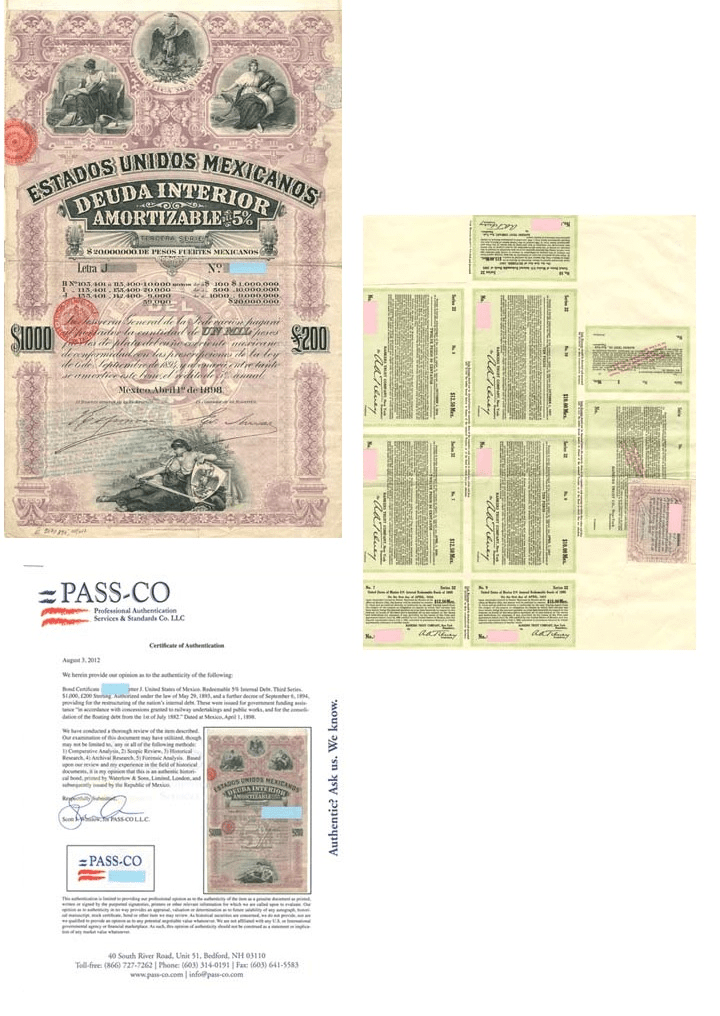

“Pink Lady Type” – £200/1000 pesos Estados Unidos Mexicanos 1898

Country: Mexico

Years: April 1, 1898

Condition: Excellent

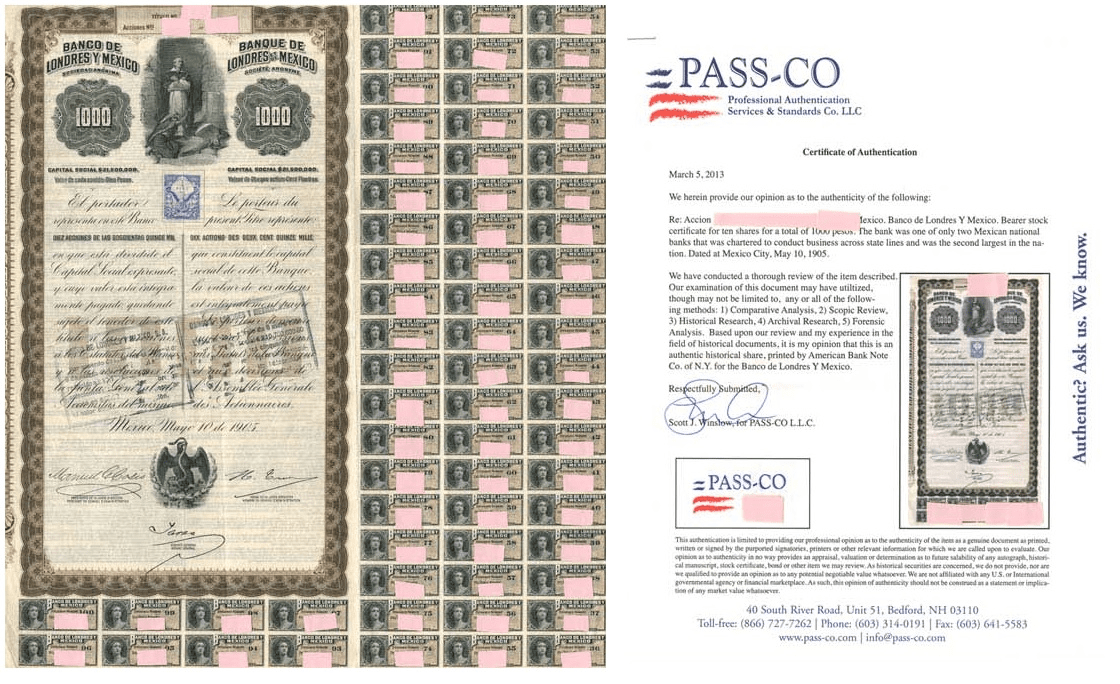

“Queen Victoria” – Banco de Londres Y Mexico – 1,000 Pesos – Bond

Country: Mexico

Years: May 10, 1905

Uncancelled Bearer Stock certificate for ten shares of $100 (pesos) each/1,000 Pesos, thus totaling $1000 (pesos). Known as the “Queen Victoria”. The bank was one of only two Mexican national banks that was chartered to conduct business across state lines and was the second largest in the nation. Extremely Rare!

Condition: Excellent

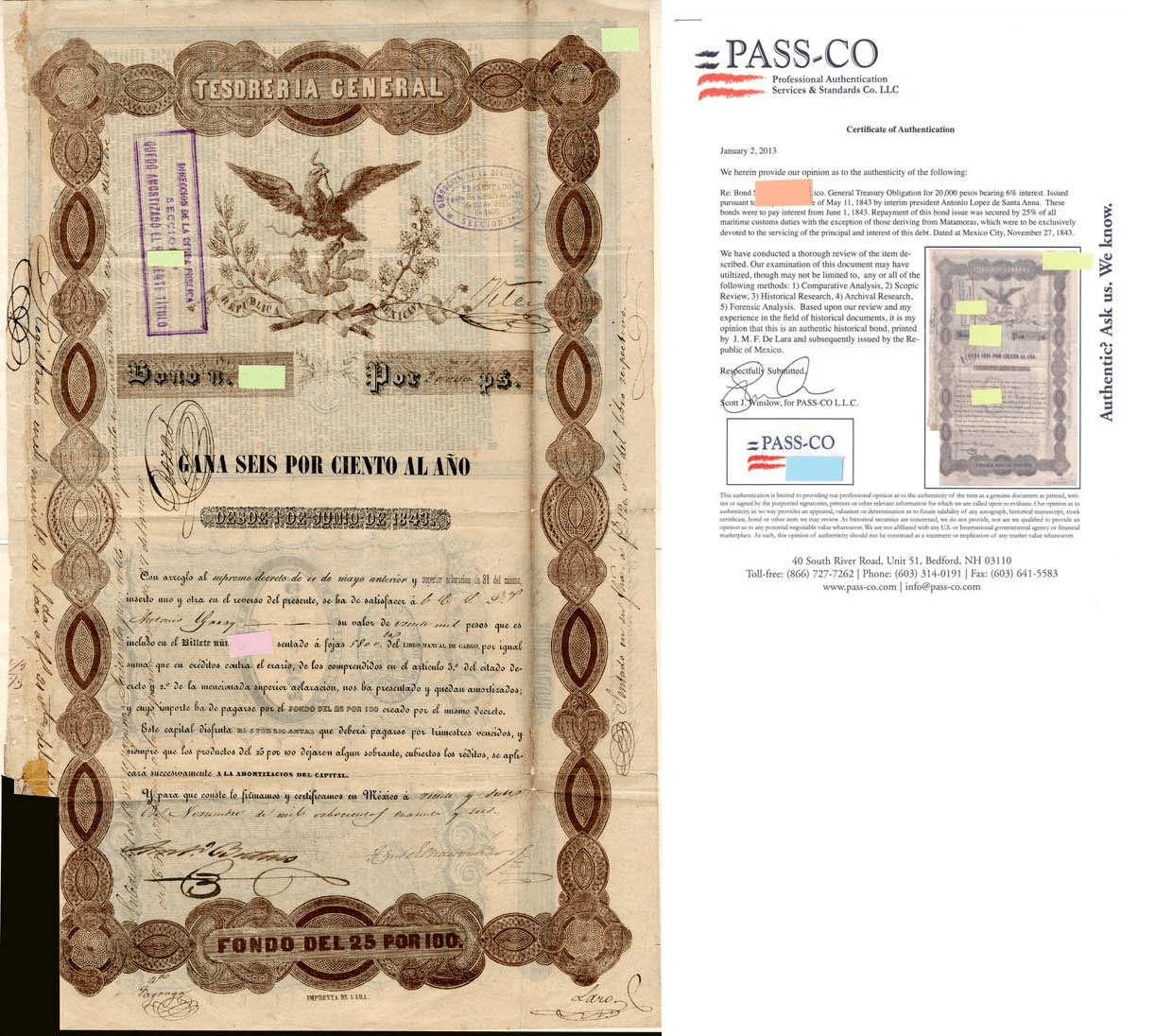

“Black Eagle” – 20,000 Pesos Tesoreria General Bond

Condition: Excellent

Important facts related to the “INFAMOUS” 27,500 denomination of the 1843 “Black Eagles”.

We regret that all the 27,500’s that exist have been fraudulently altered. Mexico never issued any of these 1843 bonds in any denomination above 20,000 Pesos. We have seen only two of the 20,000 Pesos on the market to date. This highest ligitimate denomination is truly rare. As for the 27,500’s, only fraudulent examples exist with various digits erased and altered in the denomination. These altered (faked up) bonds have no merit or value. Unfortunately, hundreds of people are being sent on a “wild goose chase” to find them. There are reports that there are a few authentic examples, however this is not true. All in all 27,500’s are fraudulent.

Imperial Government of Russia 4% 1890 Gold Bond

Country: Russia

Years: 1889

3125 Roubles Uncancelled 4% Gold Bond. This Bond represents 25 Bonds in 1.

Condition: Excellent

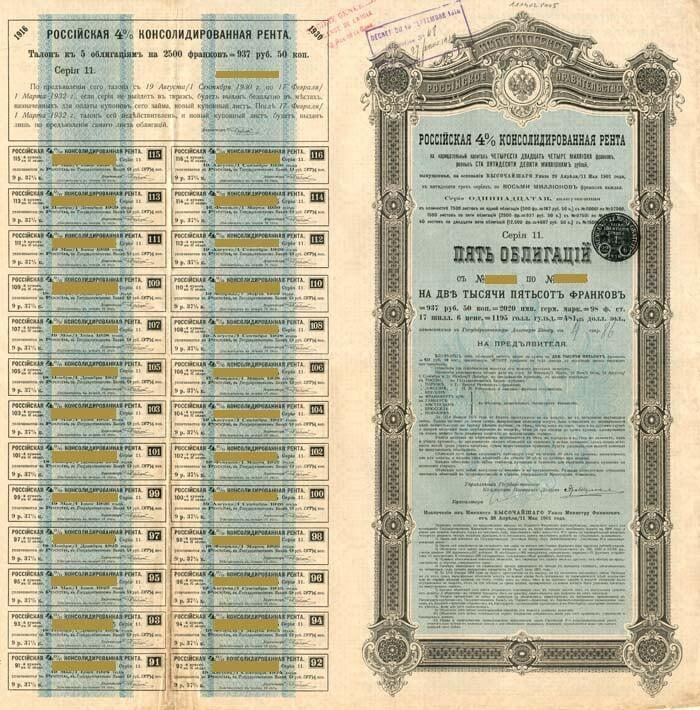

Imperial Government of Russia 4% 1901 Gold Bond

Country: Russia

Years: 1901

2,500 Francs 4% Bond. 5 Bonds in One!

Condition: Excellent