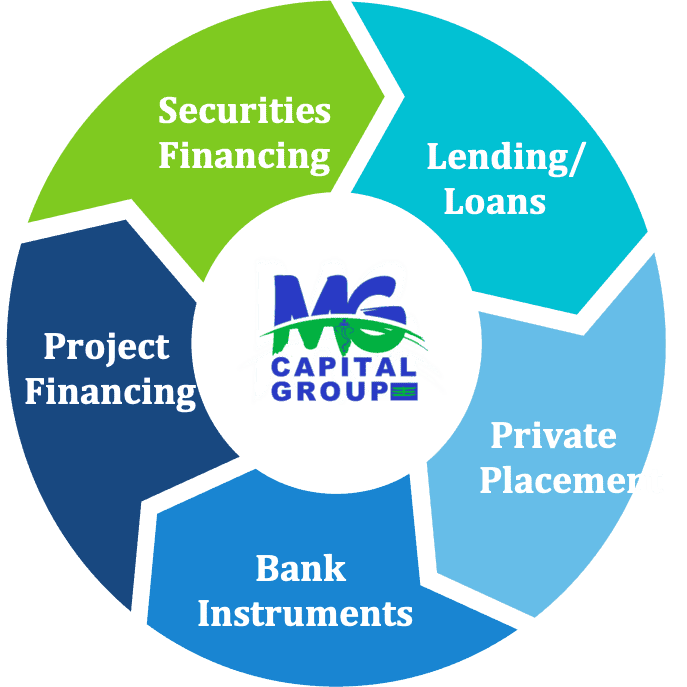

Our Services

We provide our Clients business finance solutions and help them grow their business and also assist clients Invest in Secure High Yield Investments programs for higher returns.

Investments

Real Private Placement Programs (also known as Secured Asset Management Programs) provide effortless income for self-certified sophisticated investors, high net worth individuals and companies by way of fully managed and secure investment programs. Private Placement Programs, Small Cap and Micro Cap Investment Programs are available to grow your income.

Bank Instruments

MG Capital Group Inc. has a network of established private providers of bank instruments services who can provide seasoned or freshly cut bank instruments like BG's (Bank Guarantee), MTN's (Medium Term Note), SBLC's (Standby Letter of Credit) and just about every other type of instruments available through our network.

Project Finance

MG Capital Group Inc. (MGCG) assists clients worldwide who want to achieve their project financing objectives. We assist clients in their attempt to secure funding by working on their funding requests that may require innovative financing.We have strategic partnerships with many trusted lenders who are prepared to fund projects.

Wealth Management

MG Capital Group works with authorized agents and program directors of top tier global banks with trading platforms and private placement programs that enable approved clients to privately place some of their own investable funds to generate above-market returns from leveraged bank trading, with the peace of mind of having their capital protected.

Trade Finance

We assist our clients in Trade finance, providing purchase order financing, letters of credit, receivable financing and creative short-term transactional financing for importers, exporters, and other short-term borrowers. Our extensive service in trade finance allows us to deliver quick turnaround and immediate answers to small and medium borrowers.

Lending

Our loan products offer solutions to real estate investors and companies who banks can’t help. Our success is based on strong relationships within the broker and borrower community. Our strategic investor relationships allow flexibility to meet borrower demands.