What is Scripophily & FAQ

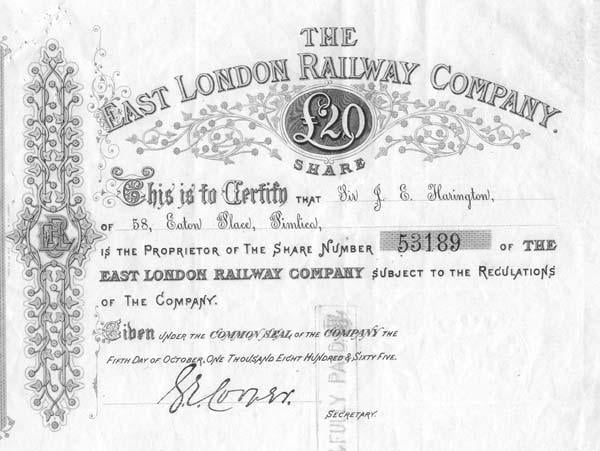

Scripophily is the study and collection of stocks and bonds. Some people refer to scripophily as a specialized field of numismatics. Scripophily is an interesting area of collecting due to both the inherent beauty of some historical documents as well as the interesting historical context of each document.

Scripophily gained recognition as a hobby around 1970. The word “scripophily” was coined by combining words from English and Greek. The word “scrip” represents an ownership right and the word “philos” means to love. Today there are thousands of collectors worldwide in search of scarce, rare, and popular stocks and bonds.

Many collectors like the historical significance of certificates. Dot com companies and scandals have been particularly popular. Railroads is another area widely collected. Others prefer the beauty of older stocks and bonds that were printed in various colors with fancy artwork and ornate engraving

A part of scripophily is the area of financial history. Over the years there have been millions of companies which needed to raise money for their business. In order to do so, the founders of these companies issued securities. Generally speaking, they either issued an equity security in the form of stock or a debt security in the form of a bond. However, there are many varieties of equity and debt instruments.

Each certificate is a piece of history about a company and its business. Some companies became major successes, while others were acquired and merged with other companies. Some companies and industries were successful until they were replaced by new technologies. The color, paper, signatures, dates, stamps, cancellations, borders, pictures, vignettes, industry, stock broker, name of company, transfer agent, printer, and holder name all add to the uniqueness of the hobby.

Where do I start?

Where can I buy bonds and stock certificates?

- Dealers

- Auctions

- Bourses

- The Internet, eBay also have a large number of items available

What is a share?

- Shares are issued by businesses (usually companies).

- Shares form part of the permanent finance of a business. Normally, they are never repaid, and the investor can recover his money by selling to another investor.

- Many shares earn dividends, depending on how well the business is performing.

- A shareholder is a part-owner of the business.

What is a Bond?

- Bonds are issued, not only by businesses, but also by national, state or city governments, or other public bodies, or sometimes by individuals.

- Bonds are a loan to a company or other body; they are normally repayable within a stated period. Before repayment bonds can be traded or sold to other interested parties.

- Bonds earn interest at a fixed rate, which must usually be paid by the undertaking regardless of its financial results.

- A bondholder is a creditor of the undertaking

Decorative quality

Historical importance

Many certificates were issued to finance events of importance by companies of significance in their field. Many collectors feel bonds of the Confederate State of America or by the English South Sea Company to be historically important. Early railroads or early manufacturers of automobiles and aircraft are also considered historically important.

Autographs

The original signature of a famous person on a certificate generally enhances the value but collectors should be aware that many signatures are printed in facsimile, and others may be signed by clerks on behalf of their employers.

How is the value of a bond or share determined?

Like anything else, the value is what someone is willing to pay. Prices of certificates can vary from a few cents to thousands of Euros or Dollars. Here are some of the things collectors define as important in determining value.

Rarity

- Recently several auction firms and dealers have begun to use the following rarity scale for certificates:

- R12 – only 1 certificate known

- R11 – only 2 known pieces

- R10 – 3 to 5 known pieces

- R9 – 6 to 10 known pieces

- R8 – 11 to 25 known pieces

- R7 – 26 to 50 known pieces

- R6 – 51 to 100 known pieces

- R5 – 101 to 250 known pieces

- R4 – 251 to 500 known pieces

- R3 – 501 to 1000 known pieces

- R2 – 1001 to 5000 known pieces

- R1 – over 5001 known pieces

Age

- Usually older certificates are more sought after than newer certificates.

Condition

- It is wise to collect certificates in the best condition possible. A common grading scale used by many dealers and auctioneers is:

- Uncirculated – looks like new, no abnormal markings or folds, no staples, clean signatures and no stains

- Extremely fine – slight traces of wear

- Very fine – minor traces of wear

- Fine – creased with clear signs of use and wear

- Fair – strong signs of use and wear

- Poor – some damage with heavy signs of wear and staining